What Are Convertible Bonds Examples . Why do companies issue convertible bonds? Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Web convertible bond calculation example. Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. Find out the advantages and disadvantages of. Web convertible bond example. The issuer offering convertible bonds typically expects their share price to appreciate in. Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and a delayed dilution of common stock for corporations. Web convertible bonds are hybrid securities that pay interest and can be converted into stock. Learn how they work, why. Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined.

from efinancemanagement.com

Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. The issuer offering convertible bonds typically expects their share price to appreciate in. Learn how they work, why. Web convertible bond calculation example. Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined. Web convertible bond example. Find out the advantages and disadvantages of. Web convertible bonds are hybrid securities that pay interest and can be converted into stock. Why do companies issue convertible bonds?

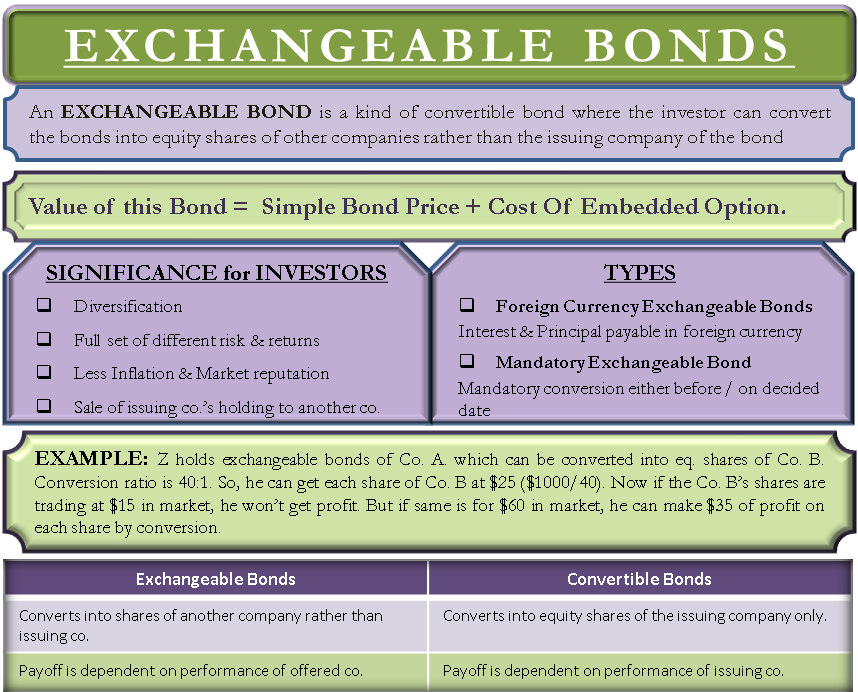

Exchangeable Bonds Types, Example, Value, Vs. Convertible Bonds

What Are Convertible Bonds Examples Find out the advantages and disadvantages of. Web convertible bond example. Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and a delayed dilution of common stock for corporations. Web convertible bond calculation example. The issuer offering convertible bonds typically expects their share price to appreciate in. Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined. Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Learn how they work, why. Why do companies issue convertible bonds? Find out the advantages and disadvantages of. Web convertible bonds are hybrid securities that pay interest and can be converted into stock.

From www.financestrategists.com

Convertible Bonds Definition, Types, Features, Pros, & Cons What Are Convertible Bonds Examples Find out the advantages and disadvantages of. Learn how they work, why. Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. Why do companies issue convertible bonds? Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for. What Are Convertible Bonds Examples.

From www.slideshare.net

CONVERTIBLE BOND What Are Convertible Bonds Examples Find out the advantages and disadvantages of. The issuer offering convertible bonds typically expects their share price to appreciate in. Web convertible bond calculation example. Web convertible bond example. Why do companies issue convertible bonds? Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and a delayed dilution of common stock for. What Are Convertible Bonds Examples.

From www.financestrategists.com

Features of Convertible Bonds Finance Strategists What Are Convertible Bonds Examples The issuer offering convertible bonds typically expects their share price to appreciate in. Find out the advantages and disadvantages of. Why do companies issue convertible bonds? Web convertible bond example. Web convertible bonds are hybrid securities that pay interest and can be converted into stock. Web learn how convertible bonds are a form of equity financing that offers a lower. What Are Convertible Bonds Examples.

From www.financestrategists.com

Features of Convertible Bonds Finance Strategists What Are Convertible Bonds Examples Why do companies issue convertible bonds? Web convertible bond example. Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Web convertible bonds are hybrid securities that pay interest and can be converted into stock. Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and. What Are Convertible Bonds Examples.

From wikifinancepedia.com

Convertible Bond Definition, Examples, Types and Pros What Are Convertible Bonds Examples Web convertible bonds are hybrid securities that pay interest and can be converted into stock. Why do companies issue convertible bonds? Find out the advantages and disadvantages of. Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined. Web convertible bonds are corporate. What Are Convertible Bonds Examples.

From efinancemanagement.com

Convertible Bonds Features, Types, Advantages & Disadvantages What Are Convertible Bonds Examples Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and a delayed dilution of common stock for corporations. Web convertible bond calculation example. Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined. Learn how. What Are Convertible Bonds Examples.

From www.slideserve.com

PPT Convertible Bonds PowerPoint Presentation, free download ID1707065 What Are Convertible Bonds Examples Learn how they work, why. Why do companies issue convertible bonds? Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and a delayed dilution of common stock for corporations. Web a convertible bond is a. What Are Convertible Bonds Examples.

From www.investopedia.com

An Introduction to Convertible Bonds What Are Convertible Bonds Examples Web convertible bond calculation example. Why do companies issue convertible bonds? Web convertible bonds are hybrid securities that pay interest and can be converted into stock. Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. The issuer offering convertible bonds typically expects their share price to appreciate in. Web learn how convertible. What Are Convertible Bonds Examples.

From managefinancefund.com

Convertible Bonds Meaning, Examples, Types and Advantages What Are Convertible Bonds Examples Web convertible bond example. Why do companies issue convertible bonds? Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and a delayed dilution of common stock for corporations. Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond. What Are Convertible Bonds Examples.

From moneyfortherestofus.com

Convertible Bonds Everything You Need to Know Money For The Rest of Us What Are Convertible Bonds Examples Web convertible bonds are hybrid securities that pay interest and can be converted into stock. The issuer offering convertible bonds typically expects their share price to appreciate in. Web convertible bond example. Learn how they work, why. Web convertible bond calculation example. Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Find. What Are Convertible Bonds Examples.

From www.financestrategists.com

Convertible Bonds Definition, Types, Features, Pros, & Cons What Are Convertible Bonds Examples The issuer offering convertible bonds typically expects their share price to appreciate in. Web convertible bond calculation example. Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and a delayed dilution of common stock for corporations. Learn how they work, why. Learn how they work, their advantages and disadvantages, and how to. What Are Convertible Bonds Examples.

From www.financestrategists.com

Features of Convertible Bonds Finance Strategists What Are Convertible Bonds Examples Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. Why do companies issue convertible bonds? Web convertible bond calculation example. Web convertible bonds are hybrid securities that pay interest and can be converted into stock. Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company.. What Are Convertible Bonds Examples.

From learn.g2.com

Cruising for Capital Your Guide to Convertible Bond Basics What Are Convertible Bonds Examples Web convertible bond calculation example. Why do companies issue convertible bonds? Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. Web convertible bond example. Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Web learn how convertible bonds are a form of equity financing. What Are Convertible Bonds Examples.

From mitchellewahardy.blogspot.com

Convertible Bonds Advantages and Disadvantages MitchellewaHardy What Are Convertible Bonds Examples Web convertible bond calculation example. The issuer offering convertible bonds typically expects their share price to appreciate in. Web learn how convertible bonds are a form of equity financing that offers a lower coupon rate and a delayed dilution of common stock for corporations. Web convertible bond example. Web convertible bonds are hybrid securities that pay interest and can be. What Are Convertible Bonds Examples.

From writingley.com

What are convertible bonds and how do they work Writingley What Are Convertible Bonds Examples Find out the advantages and disadvantages of. Learn how they work, why. Why do companies issue convertible bonds? Web convertible bond calculation example. The issuer offering convertible bonds typically expects their share price to appreciate in. Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. Web convertible bonds are hybrid securities that. What Are Convertible Bonds Examples.

From efinancemanagement.com

Exchangeable Bonds Types, Example, Value, Vs. Convertible Bonds What Are Convertible Bonds Examples Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined. Why do companies issue convertible bonds? Learn how they work, their advantages and disadvantages, and how to invest in them through funds or. Learn how they work, why. The issuer offering convertible bonds. What Are Convertible Bonds Examples.

From www.educba.com

Know About The Wonderful Features Of Convertible Bonds eduCBA What Are Convertible Bonds Examples Web a convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined. Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Learn how they work, why. Web convertible bond example. Web convertible bonds are hybrid securities that. What Are Convertible Bonds Examples.

From www.indiabonds.com

Understanding Convertible Bonds Benefits and Varieties IndiaBonds. What Are Convertible Bonds Examples Web convertible bond example. Web convertible bonds are hybrid securities that pay interest and can be converted into stock. Why do companies issue convertible bonds? Web convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Web convertible bond calculation example. Web a convertible bond is a type of debt security that provides an. What Are Convertible Bonds Examples.